Sports

Sitharaman continued that due to the global reach of cryptocurrencies, international cooperation was required to prevent any kind of regulatory arbitrage.

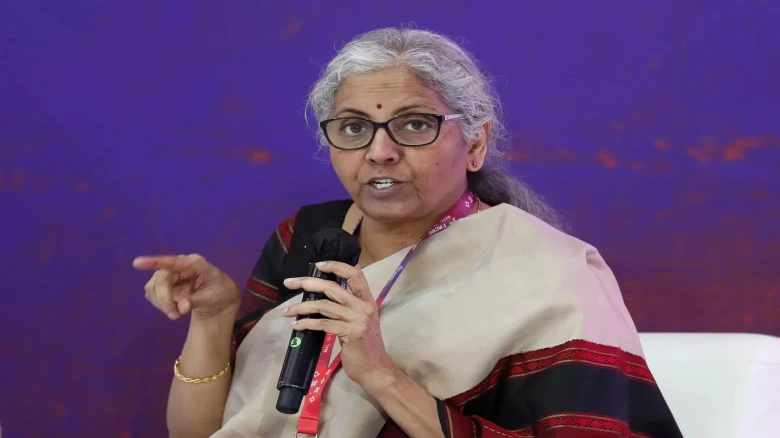

Digital Desk: The Reserve Bank of

India (RBI) has advised the government to enact laws and bans regarding

cryptocurrencies.

Finance

Minister Nirmala Sitharaman stated in Parliament on July 18 that the government

appears to be of the opinion that "global collaboration" is required

for any successful regulation or ban.

The

RBI has advised the creation of legislation for this industry in light of its

worries about the destabilising impact of cryptocurrencies on a nation's monetary

and fiscal stability.

The

finance minister wrote, "The RBI is of the opinion that cryptocurrencies

should be prohibited in response to a question in the Lok Sabha."

Sitharaman

continued that due to the global reach of cryptocurrencies, international cooperation

was required to prevent any kind of regulatory arbitrage.

"Any

legislation for regulation or for banning may only be effective after major

worldwide collaboration on appraisal of the risks and benefits and the

establishment of common taxonomy and criteria," she said.

Sitharaman's

comments are especially noteworthy in light of rumours that the government may

draught legislation to regulate the cryptocurrency industry during the current

monsoon session of Parliament. But no introduction date for such legislation

has been set.

Even

before the aforementioned bill is introduced, all eyes are on the government's

draught consultation document on cryptocurrency. The paper, which is

anticipated to clarify the government's position on cryptocurrencies, was said

to be "nearly finished" in late May. However, it is still in the

works.

The

classification of cryptocurrencies- whether they should be considered financial

assets or commodities- is also up for debate, but the government has so far

refused to publicly state where it stands on the issue. On the other hand,

Prime Minister Narendra Modi and Sitharaman have argued for concerted

international action to address the problems brought on by the use of

cryptocurrencies in recent months.

While

cryptocurrency legislation is still pending, the RBI has continued to develop

its own digital currency, which it hopes to introduce this year. The

development of private cryptocurrencies may "die" as a result of the

Central Bank Digital Currencies (CBDC), according to RBI Deputy Governor T Rabi

Sankar.

Leave A Comment