National

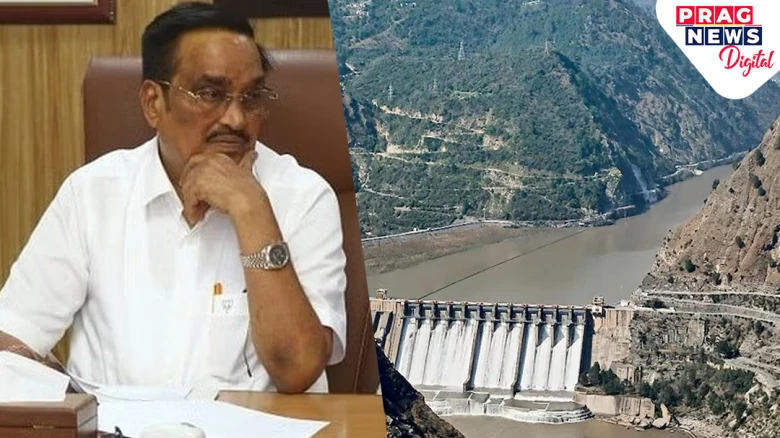

CR Paatil said that a roadmap was prepared with three options in the meeting. He added that the Indian government is working on short-term, medium-term, and long-term measures so that not even a single drop of water goes to neighbouring country Pakistan.

Leave A Comment