Regional

The RBI stated on Friday that all Rs 2,000 currency notes must be replaced by September 30, 2023...

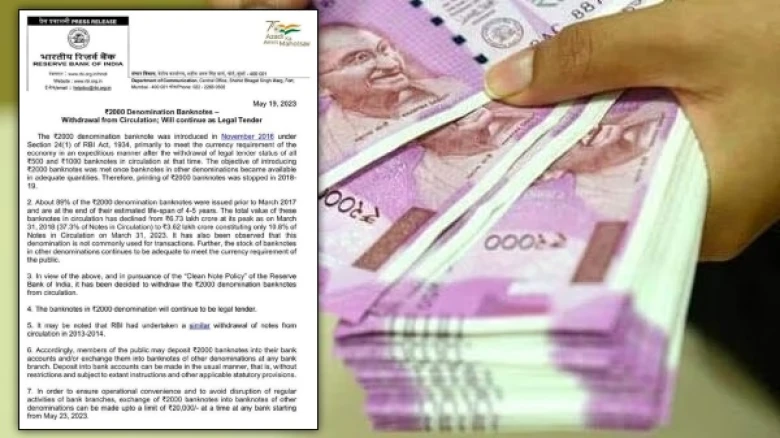

Digital Desk: In a recent development, The Reserve Bank of India chose to remove the Rs 2,000

denomination banknotes from circulation and has invited everyone to replace them by September 30, 2023. However, the Rs 2,000 notes will remain legal tender, says RBI reports.

In a statement issued on Friday, the central bank announced, "Following the Reserve Bank of India's "Clean Note Policy," it has been decided to withdraw the 2000 denomination banknotes from circulation." Banknotes in denominations of 2000 will remain legal tender. To finish the exercise on time and provide the public enough time, all institutions must provide deposit and/or exchange facilities for 2000 banknotes until September 30, 2023."

Note* - About "Clean Note Policy"

The Reserve Bank of India's (RBI) Clean Note Policy aims to provide citizens with high-quality currency notes and coins while removing gross notes from circulation.

The RBI explained the move thereby: "Approximately 89% of the 2000 denomination banknotes were issued before March 2017 and are nearing the end of their estimated life-span of 4-5 years. It further stated, "The total value of these banknotes in circulation has fallen from 6.73 lakh crore on March 31, 2018 (37.3% of Notes in Circulation) to 3.62 lakh crore on March 31, 2023 (only 10.8% of Notes in Circulation). It has also been observed that this denomination is not widely utilised for transactions. Furthermore, the stock of banknotes in various denominations remains sufficient to meet the public's monetary needs."

The general public may deposit Rs 2,000 banknotes into their bank accounts or swap them for banknotes of other denominations at any bank branch, according to the RBI. "Deposits into bank accounts can be made in the usual manner, that is, without restrictions and subject to extant instructions and other applicable statutory provisions," the statement stated.

"In order to ensure operational flexibility and to avoid interruption of regular activities of bank branches, exchange of Rs 2000 banknotes into banknotes of other denominations can be made upto a limit of 20,000/- at any bank beginning May 23, 2023," the central bank noted. Additionally, beginning May 23, the RBI's 19 Regional Offices with issuing divisions will offer the ability to exchange Rs 2,000 banknotes up to a ceiling of Rs 20,000 at a time.

Following the demonetisation of the Rs 1,000 and Rs 500 banknotes in November 2016, the Rs 2,000 currency note was issued. According to the RBI, the goal of introducing the Rs 2,000 banknotes was met once money in other denominations became accessible in sufficient amounts. As a result, the printing of the Rs 2,000 banknotes had already halted in 2018-19.

In addition to the RBI Annual Reports presented to Parliament in March by Finance Minister Nirmala Sitharaman, the total value of Rs 500 and Rs 2,000 denomination banknotes in circulation as of end-March 2017 and as of end-March 2022 was Rs 9.512 lakh crore and Rs 27.057 lakh crore, respectively.

"Banks have not been given instructions to stop filling Rs 2,000 notes in ATMs." "Banks determine the amount and denominational requirements for ATMs based on past usage, consumer demand, seasonal trends, and so on," she explained.

The elimination of the 2000 notes marks a fundamental shift in currency management and a greater emphasis on digital transactions as India evolves towards a more digitised economy. To achieve a smooth and inclusive transition for all segments of society, this transformation will rely on good communication, widespread knowledge, and the availability of solid digital infrastructure.

Also Read : Media Tycoon Rupert Murdoch set to marry for 5th time at 92. Here's the entire story

Leave A Comment