This development occurs against the backdrop of Bangladesh's upcoming general election...

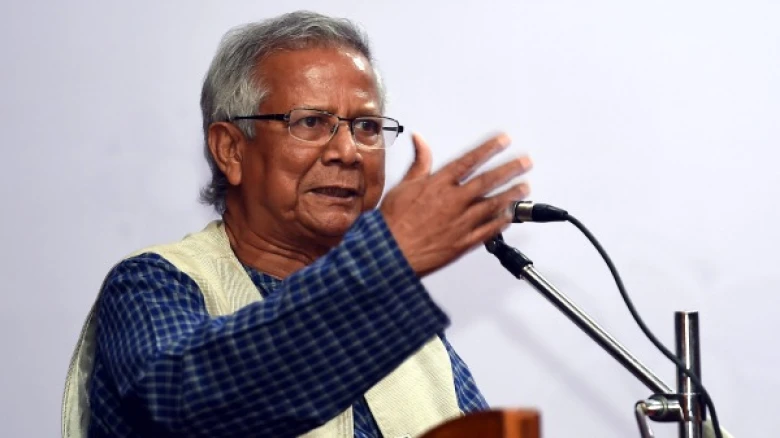

Digital Desk: In a pivotal development, Muhammad Yunus, renowned for his pioneering work in microcredit to empower impoverished communities, has been sentenced to six months in jail by a labour court in Bangladesh. The verdict, issued by Sheikh Merina Sultana, head of the Third Labor Court of Dhaka, points to labour law violations by Grameen Telecom, a non-profit founded by Yunus.

The court outlined specific infractions, including the failure to secure permanent positions for 67 Grameen Telecom employees, the absence of employees' participation and welfare funds, and the company's non-compliance with the policy to distribute 5% of dividends to staff. Grameen Telecom, with a significant stake in Grameenphone, the nation's largest mobile phone company, is at the centre of these legal proceedings.

This development occurs against the backdrop of Bangladesh's upcoming general election on January 7. The Bangladesh Nationalist Party, led by former Prime Minister Khaleda Zia, has chosen to boycott the election, citing a lack of confidence in the administration's ability to ensure a free and fair process.

Yunus is not only grappling with labour law violations but also facing charges of corruption and fund embezzlement. Supporters argue that these allegations are politically motivated. In August, over 170 global leaders and Nobel laureates, including Barack Obama and Ban Ki-moon, urged Prime Minister Sheikh Hasina to halt legal proceedings against Yunus, expressing concerns about democracy and human rights in Bangladesh.

Responding to the international outcry, Prime Minister Hasina invited experts and lawyers to assess the legal proceedings and scrutinize documents related to the charges against Yunus. The strained relationship between Hasina's administration and Yunus dates back to 2007 when Yunus announced plans to form a political party during a military-backed government's rule. This move reportedly angered Hasina, leading to accusations and criticism of Yunus.

Despite these challenges, Muhammad Yunus, founder of Grameen Bank in 1983, remains a transformative figure in microfinance, offering small loans to entrepreneurs overlooked by traditional banking systems. Despite the legal turmoil, Yunus persists as a symbol of poverty alleviation through innovative financial solutions, capturing ongoing international attention.

Leave A Comment