Sports

This comes at a time when the government is struggling to contain severe inflationary pressures, with prices of food, fuel, and crop nutrients soaring.

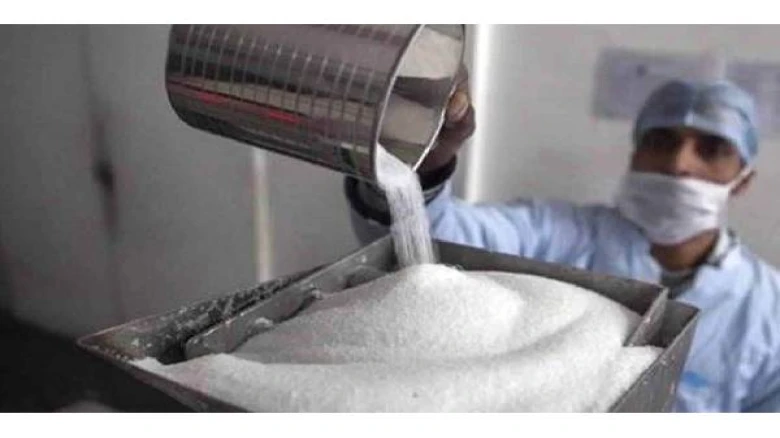

Digital Desk: The government announced

on Tuesday that sugar exports would be restricted beginning June 1 and that 20

lakh metric tonnes of crude soyabean oil and crude sunflower oil would be

imported duty-free for two fiscal years (2022-23 and 2023-24).

To

maintain "domestic availability and price stability of sugar", the

government said it would allow exports of up to 100 lakh (10 million) MTs of

sugar during the current sugar season (October 2021 to September 2022).

With

effect from 1 June 2022 up to 31 October 2022 or until further orders,

whichever is earlier, export of sugar is allowed only with specific permission

from the Directorate of Sugar, Department of Food and Public Distribution

(DFPD), Ministry of Consumer Affairs, Food & Public Distribution. "The

detailed procedure for the issue of necessary permissions for the export of

sugar will be notified separately by the Department of Food and Public

Distribution."

India

is the biggest producer of sugar in the world and the second largest exporter

after Brazil. The move comes in a year when the country is set to register its

highest-ever exports. "Contracts for export of about 90 lakh MT have been

signed in the current sugar season 2021-22. About 82 lakh MT of sugar has been

dispatched from sugar mills for export and approximately 78 lakh MT has been

exported. The export of sugar in the current sugar season (2021-22) is at its

historic high, "a source said.

Sources

said the closing stock of sugar at the end of the sugar season (September 30,

2022) remains 60-65 lakh MT, which is equivalent to about three months’ stocks

required for domestic use. As per sources, "The government has been

continuously monitoring the situation in the sugar sector, including sugar

production, consumption, and exports as well as price trends in wholesale and

retail markets all over the country”.

The

Centre also announced a duty-free import of 20 lakh MT each of crude soyabean

oil and crude sunflower oil per year for two financial years (2022-23 and

2023-24). The move – nil customs duty and nil agricultural infrastructure and

development cess - will bring significant relief to consumers, the Central

Board of Indirect Taxes and Customs said in a tweet.

This

comes at a time when the government is struggling to contain severe inflationary

pressures, with prices of food, fuel, and crop nutrients soaring.

The

retail inflation rate surged to an eight-year high of 7.79 per cent in April,

while wholesale inflation has been in double digits for 13 consecutive months.

Retail edible oil inflation remained at 20-35 per cent level all through 2021,

with the latest print for inflation rate for oils and fats recorded at 17.28

per cent for April.

The

Centre announced tax cuts on petrol, diesel, coking coal, and raw materials for

making steel over the weekend as part of its efforts to cool mounting

inflationary pressure. According to some analysts, the cut in fuel taxes could

help reduce inflation directly by around 20 basis points in June, when its full

impact will be visible. The second-round effects are likely to be equally

strong.

The

Reserve Bank of India, while reducing the repo rate by 40 bps in an

out-of-turn monetary policy meeting earlier this month, had expressed concern

over high food and fuel prices feeding into inflation.

While

this decision will have a moderating influence on price pressures in the

economy, the worry is that inflation has become entrenched and is likely to

remain above the RBI’s medium-term inflation target of 2-6 per cent.

Leave A Comment