With effect from July 7, the RBI made a significant decision by allowing banks to temporarily raise new Foreign Currency Non-Resident Bank (FCNR (B)) and Non-Resident External (NRE) deposits without taking into account the present interest rate limits. Additionally, this relaxation will be accessible till October 31, 2022.

Digital Desk: The Reserve Bank of India (RBI) on Wednesday announced a number of steps, including easing foreign investment in debt, external commercial borrowings, and non-resident Indian (NRI) deposits, to stop the rupee's decline and strengthen foreign exchange reserves.

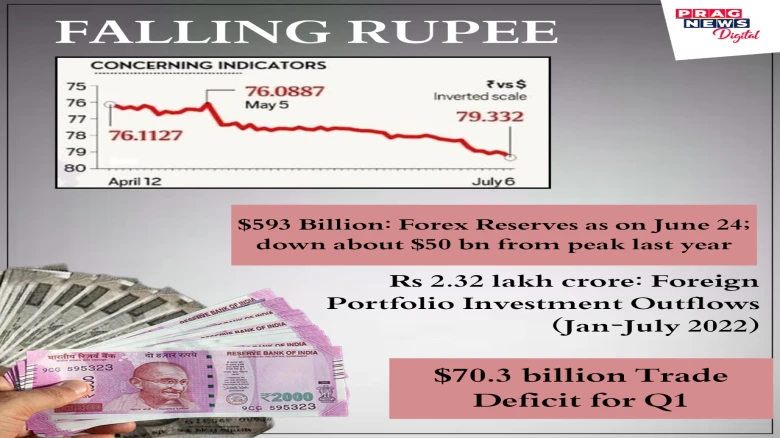

The measures are anticipated to further diversify and expand the sources of forex funding, reduce volatility, and dampen global spillovers. The rupee has depreciated by 4.1% to 79.30 against the US dollar in the current financial year as of July 5. FPIs (foreign portfolio investors) have pulled out Rs 2.32 lakh crore in the past six months.

The RBI stated that it has been regularly and closely observing the liquidity situation in the foreign exchange market and has intervened as needed in all segments to ease dollar tightness with the aim of ensuring orderly market functioning. India's foreign exchange reserves, which were at US $593 billion on June 24, 2022, are likely to increase as a result of the new measures because about a third of India's $600 billion in external debt will come due in the coming months.

With effect from July 7, the RBI made a significant decision by allowing banks to temporarily raise new Foreign Currency Non-Resident Bank (FCNR (B)) and Non-Resident External (NRE) deposits without taking into account the present interest rate limits. Additionally, this relaxation will be accessible till October 31, 2022.

The overnight Alternative Reference Rate (ARR) for the relevant currency/swap plus 250 basis points for deposits with a term of 1-3 years and the overnight ARR + 350 points for deposits with a maturity of 3-5 years currently serve as caps on interest rates on FCNR (B) deposits. Interest rates on NRE deposits should not be any higher than what banks are willing to pay on equivalent domestic currency term deposits.

The Central Bank said that until October 31, 2022, investments made by FPIs in business and government debt will be excluded from this short-term cap. These won't be taken into account when calculating the one-year limit until maturity or sale of such investments. Investments in corporate bonds and government securities cannot have a residual maturity of more than 30% at this time.

Furthermore, until October 31, 2022, FPIs would have a restricted window in which to participate in corporate money market securities such as commercial paper and non-convertible debentures with original maturities of up to one year. FPIs are able to hold onto their investments in these assets until they mature or are sold. When calculating the short-term investment cap for corporate securities, these investments will not be taken into account.

It has agreed to raise the ceiling for external commercial borrowing (ECB) through the automated method from $750 million or its equivalent each fiscal year to $1.5 billion. According to the RBI, the all-in cost cap set forth by the ECB framework is also being increased by 100 basis points, provided that the borrower has an investment grade rating.

The RBI has also ruled that category one banks may use offshore foreign currency borrowing (OFCBs) for lending in foreign currency to companies for a wider range of end uses, subject to the external commercial borrowings negative list (ECBs). A larger group of borrowers who would find it difficult to directly access foreign markets are anticipated to benefit from the initiative by being able to borrow money in foreign currencies. According to it, this exemption for raising such borrowings is valid through October 31, 2022.

Additionally, beginning on July 30, 2022, new FCNR (B) and NRE deposits with a reference base date of July 1, 2022, will not be subject to the statutory liquidity ratio and cash reserve ratio maintenance requirements (SLR). This relaxation will apply to deposits mobilised up until November 4, 2022, which will increase returns for NRIs.

Recession risks have clouded the outlook for the world, according to the RBI, which announced the new measures. High risk aversion has thus taken hold of the financial markets, resulting in volatility spikes, sell-offs of risky assets, and significant spillovers, such as flight to safety and demand for safe haven assets like the US dollar. As a result, it stated, emerging market economies (EMEs) are dealing with a reduction in portfolio flows and ongoing pressure on their currencies.

Additionally, beginning on July 30, 2022, new FCNR (B) and NRE deposits with a reference base date of July 1, 2022, will not be subject to the statutory liquidity ratio and cash reserve ratio maintenance requirements (SLR). This relaxation will apply to deposits mobilised up until November 4, 2022, which will increase returns for NRIs.

Recession risks have clouded the outlook for the world, according to the RBI, which announced the new measures. High risk aversion has thus taken hold of the financial markets, resulting in volatility spikes, sell-offs of risky assets, and significant spillovers, such as flight to safety and demand for safe haven assets like the US dollar. As a result, it stated, emerging market economies (EMEs) are dealing with a reduction in portfolio flows and ongoing pressure on their currencies.

According to it, the current account deficit (CAD) is small. According to the report, all capital flows, with the exception of portfolio investments, remain stable, and sufficient reserves act as a cushion against external shocks.

Leave A Comment