Regional

The 73-page document stated, "The White Paper on the State Finances is an attempt to explain the complex issues/problems faced by the Punjab government in the sphere of finance, which has grown increasingly serious over time due to the imprudence of administrations of the past."

Digital

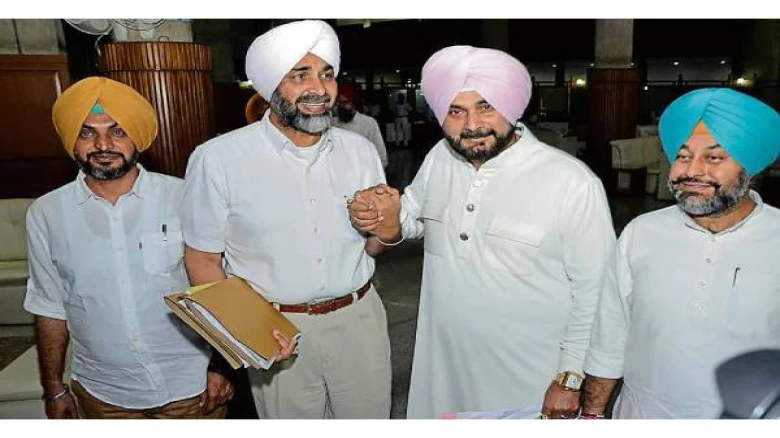

Desk: The White Paper on State Finances, tabled in the state Assembly here on

Saturday, claimed that Punjab is in an economic mess and a debt trap. Finance

Minister Harpal Singh Cheema blamed previous administrations for the budgetary

crisis in the document presented.

According

to the finance report delivered two days before the state budget was introduced

in the House, Punjab is currently in an economic disaster and a debt trap.

White

Paper stated, "The past administrations continued to engage in fiscal

profligacy instead of taking necessary corrective action." The unchecked

increase in unproductive revenue expenditure, undeserved favors, and subsidies,

the virtual cessation of investments in the social and capital sectors crucial

to future growth, and the failure to realize its potential tax and non-tax

revenues all serve as indicators of financial debt.

The

73-page document stated, "The White Paper on the State Finances is an

attempt to explain the complex issues/problems faced by the Punjab government

in the sphere of finance, which has grown increasingly serious over time due to

the imprudence of administrations of the past."

Reportedly,

Punjab's current effective outstanding debt is 2.63 lakh crore rupees or 45.88

percent of the SGDP.

It

stated that the state's existing debt indicators were arguably the worst in the

nation and were driving it farther into a debt trap.

Although

the previous administration claimed to have implemented fiscal responsibility

in managing state finances, it secretly decided not to pay off the state

government's outstanding debts.

Sadly,

they have followed the footsteps of their predecessors and passed over huge

immediate and medium-term liabilities of Rs 24,351.29 crore that the new

government must pay off over the ensuing years, according to the paper.

The

state's debt has increased by 44.23% during the past five years, which

translates to an annual compound growth rate of 7.60%.

According

to the document, the state is in a classic debt trap since a sizable amount of

the annual gross debt/borrowings contracted by the government is used to pay

off the previous debt and interest payments rather than for the state's future

development and prosperity.

It

pointed out that the state's outstanding debt has increased from Rs 1,009 crore

in 1980-81 to Rs 83,099 crore in 2011-12 and further to Rs 2,63,265 crore in

2021-22.

According

to the report, Punjab has fallen from first to eleventh place and now trails

several other states in terms of per capita income across the nation.

According

to the White Paper, the 6th Punjab Pay Commission was rushed into

implementation in July 2021, just six months before the State Assembly

elections, even though it was supposed to take effect in January 2016.

Due

to the implementation of the 6th Punjab Pay Commission, the previous

administration could not pay the arrears of revised pay from January 1, 2016,

to June 30, 2021. As a result, it is anticipated that this account's pending

liabilities will total roughly Rs 13,759 crore.

A

thorough review of the expenditure commitments and direct income growth strategies

is required to restore Punjab to its former glory days, boost economic growth

and recovery, harmonize state budgets, and lessen reliance.

The

study indicates that among the corrective measures, NSE 1.42 percent on debt,

structural, and policy efforts are needed with hitherto unheard-of levels of

ground-level implementation.

Leave A Comment