The disclosure comes after previous submissions regarding purchasers and fund amounts separately

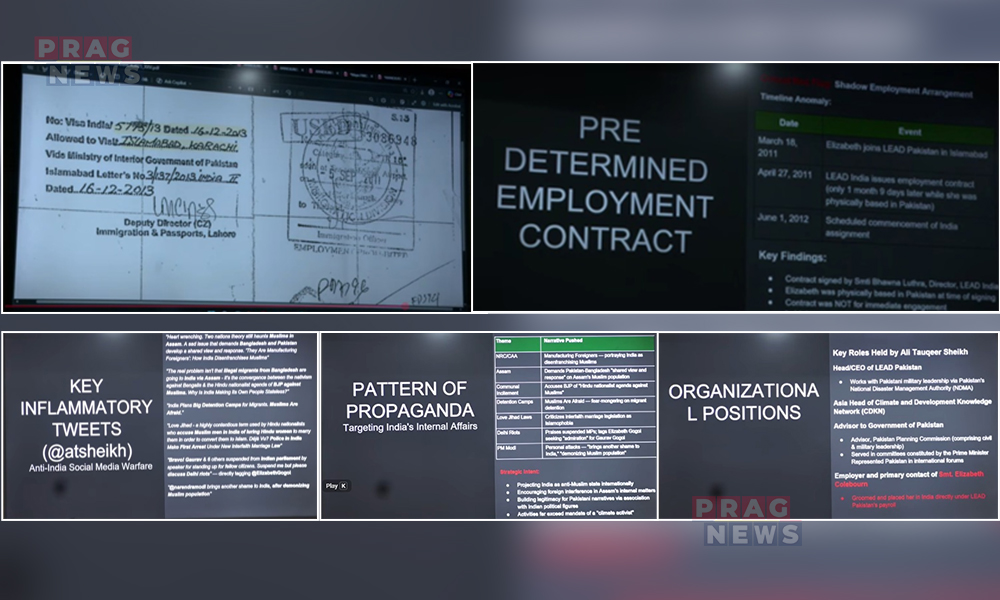

Digital Desk: The State Bank of India has submitted comprehensive details of electoral bonds, including unique alphanumeric identifiers, to the Election Commission, following the Supreme Court's directive.

This submission contains important information such as purchaser names, bond denominations, party recipients, and partial bank account numbers. While the complete account numbers and KYC details remain undisclosed for security reasons, the bank assures that political parties can still be identified without compromising security.

The particulars also include details of the electoral bond purchaser, including the URN number, journal date, date of purchase, date of expiry, name of the purchaser, bond number, denominations, issue branch code, and status.

The disclosure comes after previous submissions regarding purchasers and fund amounts separately. However, the Supreme Court states that the withholding of unique alphanumeric numbers falls short of full compliance.

Last Friday, the SC berated SBI for furnishing vague information and issued a notice to the bank to explain the causes for the non-disclosure of unique alphanumeric numbers.

Notably, prominent purchasers of electoral bonds, such as Future Gaming and Hotel Services, have been revealed, shedding light on donor details for 11 parties. While most parties disclosed only bond values, some, like the Samajwadi Party, listed specific donors and amounts.